Digital Equipment (IPO in August 1966) became #2 U.S. computer company behind #1 IBM

John Tobey (Wikipedia Commons)

Mark Cuban (born in July 1958) compares this stock market rise to 1999, driven by greed. The problem is, as he must surely know because of his experience during that time, virtually none of the key signs that accompanied that Internet Bubble are with us today, other than rising technology stocks and day trading popularity.

Jim Cramer (born in December 1955) , on the other hand, is being tossed about in the wind. He now sees investors as “clueless” and “stupidly bullish.” Forced to give daily perspective and guidance, his hectic schedule puts him at a disadvantage for introspection. Like Cuban, he relies too much on what he already knows.

Thus, two smart, experienced stock market gurus have run into a period for which they have no perspective – no experience that provides the necessary understanding of what is happening now. So, they distrust it.

Disclosure: Author was born in December 1944 and began actively trading stocks in 1964.

But, surely, they have studied history

Of course. The problem is that the past market environment that makes sense of today’s market is practically invisible. That sister market was the 1967-68 period – the so-called “go-go” market. It was unique and had no ancestor, not even the late 1920’s (only 40 years prior).

But, wait – there was no pandemic in 1967

Nope. However, we’re talking about a period of economic, business and social shakeup – just like what we’re experiencing now. A “future shock” that drove the stock market dramatically into uncharted territory. Importantly, neither were stocks frenzied nor were investors crazy (as both are currently being mislabeled).

Instead, an evolutionary groundswell was occurring. The old guard (that is, the leading 1950-1965 companies like General Motors) that were atop the post-war period in 1965 started their long fade in 1966.

It would be 28 years before GM

GM

would again reach its 1965 high. At the same time, lowly Ford, launched its winning gamble at the 1966 24 Hours of Le Mans, as shown in “Ford v Ferrari.” From there, it clocked a 500% gain as GM wallowed.

Even the acknowledged #1 technology icon, IBM

IBM

, was about to be attacked from all sides by new technology developments and new company leaders with new business approaches. (Digital Equipment Corporation, from its August 1966 IPO, would become one of the stock favorites, eventually rising to a #2 computer poisition behind #1 IBM.)

And it wasn’t just technology – all sectors and industries were fair game for those willing to take on the established, particularly those resting on laurels. Sound familiar as the coronavirus effects are already being felt – negatively and positively?

The flame is ignited…

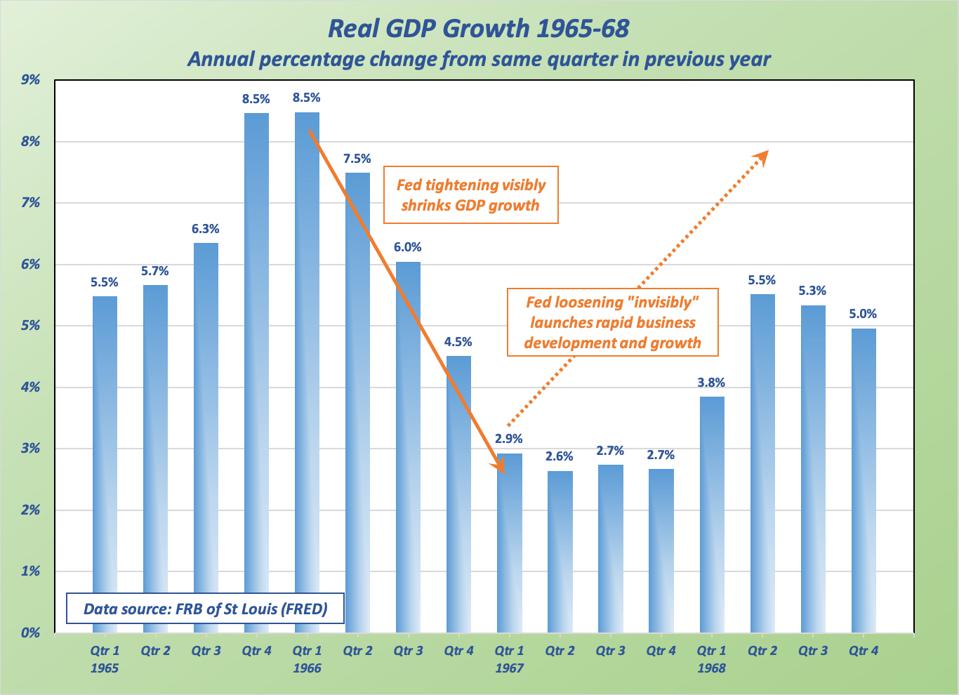

At year-end 1965, the Federal Reserve kindled the drama when it shifted to a tight money policy. Its rationale was that economic growth was too good and could lead to unacceptable inflation.

Real GDP growth from 1965 through 1968

John Tobey (FRB of St Louis – FRED)

Note: The 1966 reversal provided the Fed annals with a warning writ in bold: “Don’t mess with growth.” Hence, the eventual 1999-2000 Internet Bubble only got Greenspan’s way-too-early, tepid 1996 “irrational exuberance” warning that came to naught.

Why studying history won’t get you there

No historic study can reveal those mid-1960s shifts, undercurrents, reversals and fast progress. It was the dawning of a “future shock” age in which it seems everything is changing at warp speed. Nor can it capture the multiple thought and analytical processes attempting to make sense of all that was happening.

Even looking at stock charts won’t help. The S&P 500 was weighed down by all those big leaders turned laggards and it was further held back by its slow adoption of the fast-growing newcomers.

The Dow Jones Industrial Average (DJIA) was even worse, despite it being the main performance comparison of the time. Dow Jones failed to update, being mired in Charles Dow’s view of industrials, rails and, eventually, banks (financials) and utilities as separate indexes. They were ultra-slow to expand into new areas – particularly technology and services. Even #1 stalwart IBM wouldn’t make it into the DJIA until 1979.

Moreover, it would be a long time before Nasdaq

NDAQ

would be a real market. Instead, there was the Over-the-Counter market where stocks traded infrequently. And then there was the American Stock Exchange (AMEX) that, like the Nasdaq today, was favored by newer companies that wanted to avoid the stricter regulations and rules of the New York Stock Exchange. The AMEX was where many of the mid-1960s IPOs were listed. However, because the AMEX now is completely changed, there is no easy way to find past data, even for the old American Exchange Index.

In addition, stock charts for those leading growth companies of that period are very difficult to come by. Most were acquired, merged, split apart or otherwise altered. Names from then are: Digital Equipment, University Computing, Leasco Data, Avco, LTV, Litton, Teledyne, Textron

TXT

, Hewlett Packard

HPQ

, Itek, Fairchild Camera, Gulf & Western, Dome Petroleum, Solitron Devices, Mohawk Data, National Video, Computer Sciences, and Data Processing Financial.

But there were huge performance differences. Here is the comparison of 1967 returns:

- S&P 500 – 20.1%

- DJIA – 15.2%

- AMEX – 79.1%

And that AMEX performance, like the NASDAQ of today, is watered down by many non-growth issues.

Book titles = Good indicators of any market environment

1966’s lousy market produced a popular, negative book: “Where Are the Customers’ Yachts? – A Good Hard Look at Wall Street”

Then came the 1967-68 outstanding market, with books to match the tone:

- “Anyone Can Make a Million”

- “Beat the Market”

- “Bulls, Bears and Dr. Freud”

- “Dow 2000” (DJIA was about 900 on December 1967)

- “How to Make Big Money in the Stock Market”

- “How to Make the Stock Market Make Money for You”

- “The Money Game”

- And the best title that captures what became a goal by the end of 1967: “Happiness Is a Stock That Doubles in a Year”

Note: You may be thinking that those titles indicate a bubble of sorts. You’re right, but there were also other books stressing older, cautious strategies. It isn’t until the optimistic pendulum gets far askew that the spate of aggressively optimistic titles drive out the rational ones, thereby raising the contrarian red flag.

Only experience provides insight into this market

For that unique market, you had to be there, starting in 1965, as the last post-war classic bull market flamed out. And “being there” means not just in body. You had to be actively investing, with a daily focus on the actions and reactions as the old investing world turned upside down. It was a time of new developments, new thought processes, new management approaches, all aided by a versatile Wall Street and an accommodative Federal Reserve – just like today.

Above all, it was exciting, as I continue to describe the market we are now in. Investors learned that accepting the environment of change and acting quickly was an appropriate (not stupid, foolish or greedy) investing strategy.

The bottom line

This stock market period is a time to learn and earn. The payback from this experience will be much more than potential profits. More importantly will be the long-term benefits of the strength of independent thought, understanding and decision-making. In addition, this period will bestow an appreciation of the capitalist system’s ability to adjust, recover, innovate and grow – even in the face of economists’ dire visions.

So… Don’t wait. Jump in the pool and learn to swim in a true speculative growth market.

Leave A Comment?

You must be logged in to post a comment.