If there’s one thing Canadians need right now, and badly, it’s money. While we thought the worst was over, the COVID-19 pandemic may have only just begun. On top of that, the economic crisis that we are currently going through will only continue to worsen in the next year or so.

There are a few reasons for this. Governments around the world already had an enormous amount of debt, making us due for a recession. But then the pandemic hit. This debt soared overnight, as governments needed to make sure citizens were able to make ends meet. Enter programs such as the Canada Emergency Response Benefit (CERB).

So, while that program may have helped the markets, it has come to an end. We will end up having to pay for these programs through taxes. So, don’t expect markets to remain high for long.

People are looking for other opportunities, especially in a market that is wildly volatile. With stock prices so low, it could mean many could bounce bank even within a day before dropping again. Enter the use of day trading.

What is day trading?

It’s pretty self-explanatory. Day trading means trading a stock during one market day. By training to look for signs that there will be a market boom or bust within the day, day traders can use these techniques to decide when it’s the right time to buy and when to sell. Mainly, this has to do with day traders paying close attention to short-term events that would move the chosen stock.

There are a number of strategies used by day traders. There is scalping, where traders make small trades throughout the day with small profits, all adding up to a larger profit. There is news-based trading, such as when earnings are coming out. Then there’s high-frequency trading, which is mainly based on algorithms. These are just some examples.

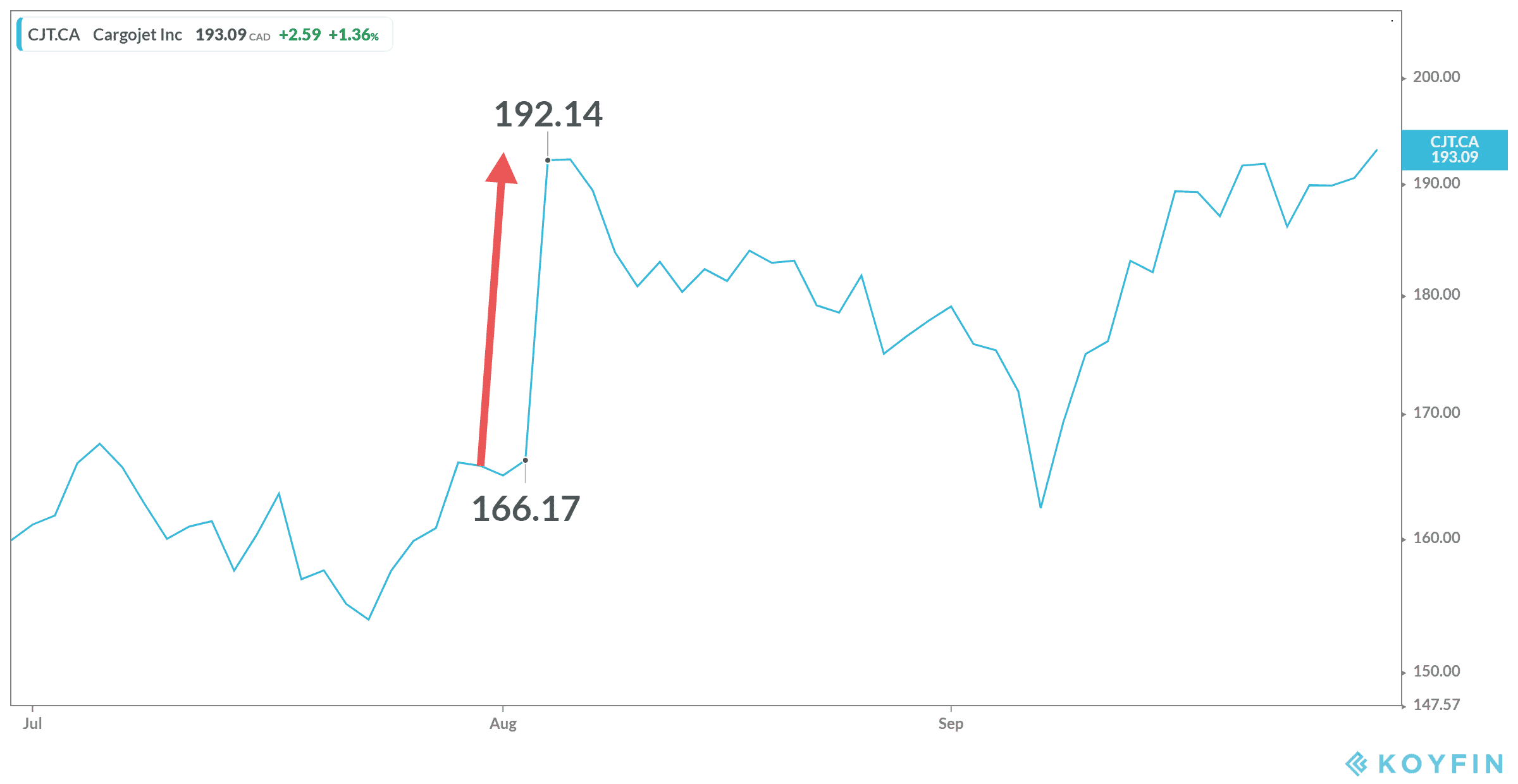

There are those traders who claim to be able to make a living by day trading! After all, earnings reports alone tend to move the markets. For example, look at Cargojet (TSX:CJT). During the last earnings report, the shipping company managed to see huge one-day gains. The stock rose by 17% in just a day when the company reported its earnings.

Let’s say you used the strategy of the news-based trading. You buy up the stock as soon as the markets open. Most day traders have a price in mind that they hope the stock will reach, using that as a mechanical guideline to sell. However, many investors tend to rely on their gut, selling when they are either too nervous or too greedy. But it’s true; you could have turned a $10,000 investment into $11,172 in just a day!

Is it worth it?

In short: no. There are multiple reasons. First, you have to be so in tune to the market, and day trading takes an enormous amount of training to try and be successful. While there are likely going to be days you could see thousands more in your account, it’s more likely you’ll see it drop by thousands. It’s not as easy as just picking a stock, or everyone would do it. It’s a very risky method of investing.

Then there’s the Tax-Free Savings Account (TFSA) to consider. First, you cannot use this account to day trade. That leaves all this cash vulnerable to taxes, or else your TFSA would be declared a business account. But if you still think you can hack it, most banks offer a tool to create a fake portfolio. Try your hand and see how you do!

Beyond that, the best strategy, though less exciting, and to buy and hold for the long term. Do your research, but do it into companies that you believe have staying power. Then there’s a high likelihood that you’ll see these stocks grow by those thousands you wanted, just during a longer period of time. Again, with Cargojet as an example, the stock is now back where it was from that one day of trading. So, you would have made the same amount with far less risk.

And here is the next big thing since e-commerce stocks.

Motley Fool Canada Makes 5G Buy Alert

5G is one of the greatest arrivals in technology since the birth of the internet. We could see plenty of new wealth-building opportunities in 2020 that would potentially dwarf any that came before them.

5G has the potential to radically change our lives and society as we know it, but if you’re an investor, the implications are even greater — and potentially much more lucrative.

To learn more about it and its revolutionary potential to change the industry — and potentially your bank account — click on the link below to get the full scoop.

Fool contributor Amy Legate-Wolfe owns shares of CARGOJET INC. The Motley Fool owns shares of and recommends CARGOJET INC.

Leave A Comment?

You must be logged in to post a comment.