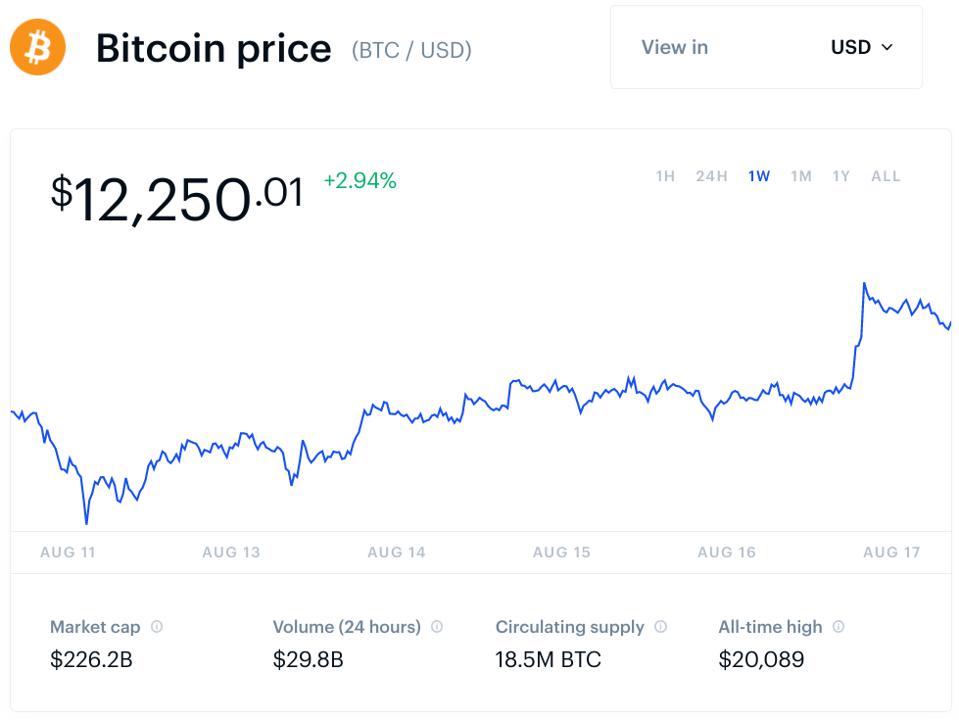

Bitcoin has leaped higher this week, climbing to year-to-date highs and reaching levels not seen since June last year.

The bitcoin price jumped almost 4% on Monday to hit highs of $12,470 per bitcoin on the Luxembourg-based Bitstamp exchange before falling back slightly.

The latest bitcoin rally, adding to gains of around 30% over the last month, came after high-profile day trader Dave Portnoy called for a bitcoin “pump” and data showed that, after Tesla stock, bitcoin was the most viewed asset in the U.S. last month.

Bitcoin has been on a tear over the last month, breaking out of a three-month-long malaise.

SOPA Images/LightRocket via Getty Images

Portnoy’s rallying call to bitcoin and cryptocurrency traders has added to a surge of retail interest in crypto, sparked by big-name investors, Wall Street giants and corporates piling into bitcoin in recent months.

Bitcoin has climbed over the last month as red-hot stocks such as electric car-maker Tesla have taken a breather following near-unprecedented gains since April.

“The data clearly shows that Tesla and bitcoin are the two assets everyone is looking at most often,” TradingView analysts wrote in a post outlining its findings.

The data chimes with a report from London-based digital asset management firm CoinShares, out earlier this month, that found “bitcoin, in its growth phase, behaves like a tech stock.”

“Interest in Tesla and bitcoin is growing due to fear-of-missing-out (FOMO) private investors, who are increasingly willing to join the success story,” FxPro senior analyst Alex Kuptsikevich said via email, adding both bitcoin and Tesla represent investment that induce “a high level of adrenaline among traders.”

“This is almost like a rookie game against the pros. Professionals do not see the ‘business’ in bitcoin and massively short Tesla, a company that accrued massive losses for years and has a tiny share on the overall car market. It appears incredibly overbought by most multipliers and indicators.”

Despite the naysayers, Tesla stock has added an eye-watering 400% to its value since January—with bitcoin so far adding a paltry 70%. But Portnoy, who live streams his Wall Street bets as Davey Day Trader, is out to change that.

“Davey Day Trader is taking the crypto world by storm,” bitcoin and cryptocurrency analyst Scott Melker wrote this week, warning traders to “beware.”

Portnoy, the founder of the Barstool Sports blog and leader of a so-called “army of day traders,” made the switch to bitcoin and cryptocurrency in just the last week, following an interview with the Winklevoss twins of Facebook-founding fame, who created the New York-based Gemini crypto exchange in 2014.

“The thing I like about pump and dumps in crypto is that it’s encouraged,” Portnoy told his day-trading live stream viewers and his 1.7 million followers on Twitter, adding that, after months of eschewing crypto in favour of stocks, he has a new sponsor: bitcoin and crypto lending company BlockFi.

“In crypto, you can pump and dump all day long,” Portnoy said before posting memes designed to further drive the soaring cryptocurrency Chainlink.

Bitcoin’s latest rally took it above the closely-watched $12,000 per bitcoin level, with the bitcoin … [+]

Coinbase

Portnoy’s comments have received a mixed reception among the bitcoin and cryptocurrency community, with some concerned a sudden influx of new investors looking to get-rich-quick will lead to a late 2017-style boom and bust for bitcoin—with bitcoin climbing to around $20,000 before heavily crashing back.

“Now we have Dave Portnoy openly and deliberately promoting shitcoins,” widely-respected bitcoin and crypto analyst and founder of money management firm Quantum Economics, Mati Greenspan, wrote in his daily newsletter.

“His claim that pump and dump schemes are encouraged in crypto is not a good look for the community, and certainly a step back from building the internet of value.”

Leave A Comment?

You must be logged in to post a comment.